In This Article We Know ICICI RTGS Charges 2023, What Is RTGS?, ICICI Bank RTGS Form, ICICI RTGS Timing, RTGS And NEFT Difference, Benefits of ICICI RTGS,

ICICI RTGS Charges 2023: Designed for substantial transactions, the RTGS system requires a minimum remittance of Rs 2 lakh and allows a maximum limit of Rs 10 lakh per day. Access the ICICI Bank RTGS Form for information on rules, timing, and charges. Real Time Gross Settlement (RTGS) facilitates instantaneous fund transfers to any bank across India. This service enhances the efficiency of your transactions, expanding their reach with reduced restrictions.

What Is RTGS?

The Real Time Gross Settlement (RTGS) is a nationwide payment system that enables one-to-one electronic funds transfer. Within this scheme, individuals can electronically transfer funds from any bank branch to another individual holding an account with any participating bank branch across the country.

NEFT functions as an electronic fund transfer system operating on a Deferred Net Settlement (DNS) basis, settling transactions in batches. Within DNS, settlements occur with all transactions received until a specified cut-off time, where netting of transactions (payables and receivables) takes place in NEFT. In contrast, RTGS settles transactions individually. Transactions initiated after a designated settlement time in NEFT must wait until the next scheduled settlement time. Conversely, in RTGS, transactions are processed continuously throughout its business hours.

How does it benefit customers?

Benefits of ICICI RTGS: Customers have the ability to swiftly transfer funds to accounts in other bank branches, and the transfer of funds occurs instantly at minimal charges.

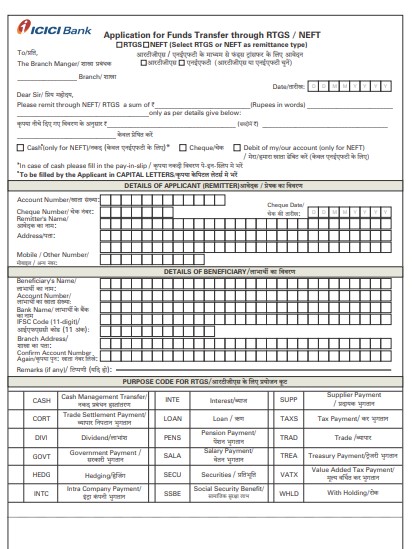

ICICI Bank RTGS Form

Download Link: Click Here

Read Also: HDFC Bank RTGS Form 2023: RTGS Charges In HDFC Bank, Timing, Full Process

ICICI RTGS Chagres 2023

ICICI RTGS Charges 2023 Full Deatils

| Mode of Transaction | Charges |

|---|---|

| Online modes (i.e. internet banking, iMobile app, Mera iMobile app and Pockets app) | No Charges |

| Through branches | |

| ₹2 lakh up to ₹5 lakh | ₹20 + applicable GST |

| ₹5 lakh up to ₹10 lakh | ₹45 + applicable GST |

ICICI RTGS Minimum And Maximum Amount Transfer

The RTGS system is specifically designed for high-value transactions, with a minimum remittance amount of ₹2 lakh per day and a maximum amount of ₹10 lakh per day.

How to Make Payments Using RTGS

There are two methods for initiating payments through RTGS:

- RTGS via Bank Branch: If you prefer to conduct RTGS transactions offline, i.e., from a bank branch, you should visit your nearest ICICI Bank branch. Request an RTGS Form or Slip, complete all the necessary details, and submit the form to the cashier. Your bank branch will then process the payment to the recipient within 2 working hours.

- ICICI RTGS Via Internet Banking: You can also utilize your ICICI Bank Internet Banking Service to send money through RTGS. To use Internet banking, log in to the ICICI Bank website, add a new beneficiary, and proceed with the RTGS payment. Online RTGS is available for all ICICI Bank customers with Internet Banking access and full transaction rights.

To access the ICICI Bank RTGS Facility, you can download the application form or visit your ICICI Bank branch to submit the duly filled form. If you are already an ICICI Bank Connect customer with “view right” and wish to have full transaction rights, please resubmit your application form (available for download from the provided URL) to your base branch.

- Log in to ICICI Bank Retail NetBanking.

- Navigate to the left-hand side bar and select “Other Bank Transfer – RTGS” under the Funds Transfer section.

- Complete all required details, including transfer amount, destination account number, IFSC Code, beneficiary name, and payment details.

- After accurately filling in these details, a unique transaction confirmation number will be generated.

- This transaction confirmation number should be quoted for any queries related to this specific transaction.

When does the beneficiary account receive the credited amount?

- ICICI Bank RTGS operates 24×7, 365 days a year.

- Confirmed transactions are immediately debited from the source account and processed, provided they are initiated before the cut-off time on the same day.

- Transactions initiated outside RTGS hours or on RTGS holidays will be processed for onward transfer to the beneficiary bank on the next working day.

- Ensure sufficient funds are available in your account for transaction processing. If retrying, check the status of your previous transaction.

- Note that once the amount is debited and processed by ICICI Bank, the credit into the beneficiary account is entirely dependent on the destination bank.

Deadline for Fund Transfer via

Typically, the recipient branches are anticipated to receive the funds instantly upon transfer by the sending bank. The beneficiary bank is required to credit the recipient’s account within 30 minutes of receiving the funds transfer message under normal circumstances.

ICICI RTGS Timing

ICICI RTGS Timing: The advance scheduling window for an RTGS transaction is 3 working days. You can utilize this for payments related to:

- Cash Management Transfer

- Hedging

- Interest

- Loan

- Securities

- Supplier Payment

- Tax Payment

- Trade

- Trade Settlement Payment

- Value Added Tax Payment

If none of the above options align with your transaction, please default to selecting “Cash Management Transfer.”

RTGS And NEFT Difference

- Both RTGS (Real Time Gross Settlement) and NEFT are provided by RBI for conducting online funds transfers among member banks.

- Following RBI guidelines effective November 15, 2010, RTGS is applicable only for transactions of Rs.2,00,000/- and above.

- For transactions below Rs.2,00,000/-, NEFT should be utilized.

Benefits of ICICI RTGS

- Benefits of ICICI RTGS: ICICI Bank RTGS is available to all users, including both existing and new Net banking customers.

- The RTGS Facility at ICICI Bank is straightforward, convenient, quick, and secure, allowing users to transfer funds seamlessly to beneficiaries in other banks with speed and safety.

- Customers can utilize ICICI Bank RTGS anytime and anywhere, providing a simple and easy-to-operate platform from the comfort of home or office, saving time and energy.

- ICICI Bank RTGS is a cost-effective option compared to traditional remittance methods such as DD/MT, offering more value for less expenditure.

FAQ?: ICICI Bank RTGS

Real-Time Gross Settlement

The Pdf file is available to download above, so you need to click on it from here.

rewrite: Internet Banking– Add a Beneficiary using the ‘Funds Transfer’ option with the IFSC and the beneficiary bank details. Transfer funds once the beneficiary is added. Keep your mobile phone handy. An OTP will be sent to your registered mobile number.